A scene at the International Robot Exhibition (iREX 2015).

Text & Photo © CM Cordeiro, Sweden 2015

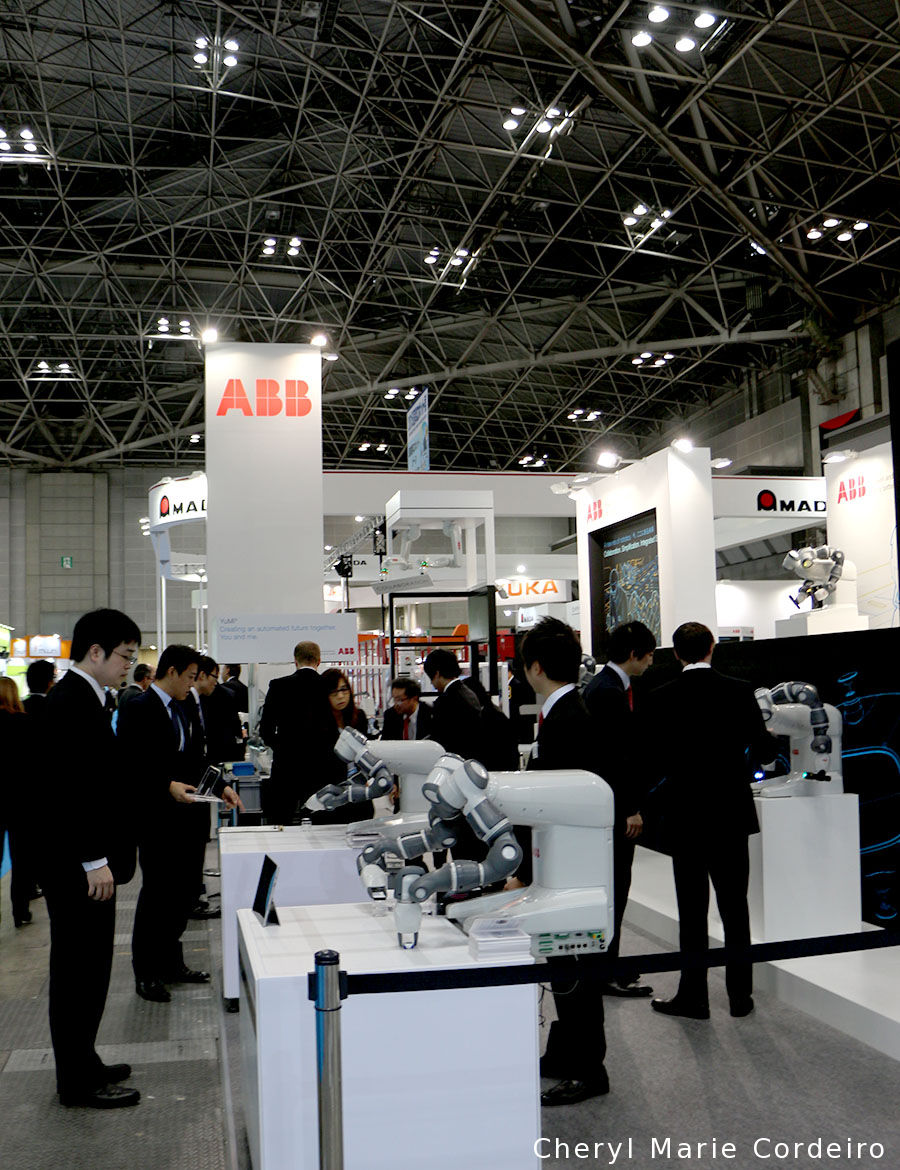

The 21st International Robot Exhibition (iREX 2015) took place between 2 to 5 December in Ariake at the Tokyo Big Sight in Tokyo, Japan. Organized bi-annually by the Japan Robot Association (JARA) and Nikkan Kogyo Shimbun, LTD and supported by varoius Japanese trade organizations, this robotics exclusive event attracts an average of over fifty multinational enterprises in exhibition and more than five thousand visitors interested in the latest robot technology.

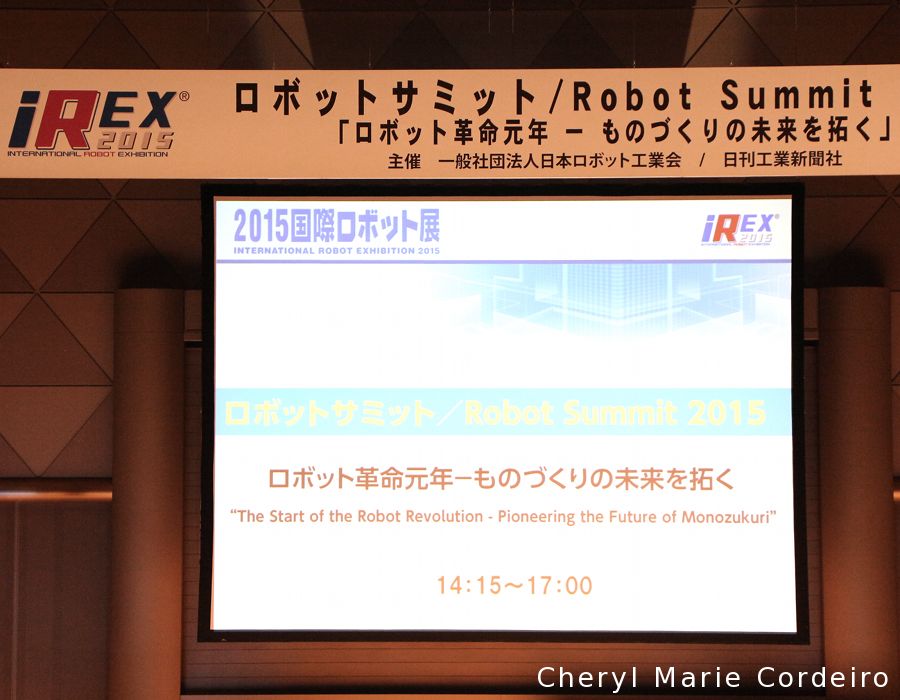

Robots have gained popular interest in recent years, firing debates on whether robot solutions are deemed as key to economic growth across the globe whether developed or emerging economies [1]. Of personal interest was the parallel Robot Summit 2015 session that saw a keynote speech entitled For Realization of Robot Revolution delivered by Japan’s Ministry of Economy, Trade and Industry, and a panel discussion take place between eight industry leaders in robotics on the theme of the pioneering efforts of the robot revolution. The eight industry representatives, moderated by journalist Mariko Mikami, in the panel discussion included:

– Kawasaki Heavy Industries represented by its General Manager, Mr. Yasuhiko Hashimoto,

– Nachi-Fujikoshi, reprented by its General Manager Mr. Akira Kunisaki,

– ABB represented by its Group Senior Vice President and Head of Robotics, Mr. Per Vegard Nerseth,

– FANUC represented by its Executive Vice President Mr. Kiyonori Inaba,

– Yaskawa Electric, represented by its Director Corporate Senior Vice President Mr. Yoshikatsu Minami,

– KUKA Roboter represented by its CEO Mr Stefan Lampa,

– Honda Engineering represented by its Managing Director Mr. Takao Shibayama and

– Fujitsu represented by its Monozukuri Development Unit Vice President, Mr. Jun Matsueda.

Global trends for robotics industry / robot revolution

A recurrent observation on important technology drivers for the robotics industry that generally saw a strong growth in the past two years [2] included digital life, cloud technology, big data, smart manufacturing and the Internet of Things (IoT). A matrix of factors that included the lowering of automation costs in conjunction with an increase in labour costs, plus an observed aging global demographics that hampers labour mobility as can be observed across various developed economies such as Japan and even China, are what are seen as driving forces to the growth of the robotics industry.

Individualisation and customisation of products drives flexibility of production and places new requirements on the robotics industry. These new requirements can be placed broadly into seven categories that include the

- lowering of cost of many new products, which means that fast payback is critical. In that sense, the investment cost in robot solutions need to decrease considerably in order for a robust launch to the robot revolution.

- Product life cycle changes means that automation will need to be flexible to diffferent product life cycles within a single system. In this sense, modularisation and reusability of a single robot model would be an upcoming focus of research and industry development. This includes building installations and automation solutions that with relatively little work, can be reset and reused for new batches of production.

- Accessibility to solution and to make automation solutions easier to apply in different contexts is needed, due to the growing unlikely scenario that operators will stay for long on the job in the manufacturing industries.

- Increased data connectivity and harvesting cloud integration capabilities that in turn presents new opportunities for product life cycle predictability, allowing for interventions to complete stops in production based on the historical data collected.

- Developing greater sensor integration that will offer a different experience of vision sensitivity in robots.

- Material transfer that enables connecting the complete material flow in a better way to the automation is key to the future and all of this set within the context of

- an understanding of the workings of Industry 4.0.

Japan’s robot strategy driver

The aging society is a serious issue for Japan, the main reason why the Headquarters for Japan’s Economic Revitalization adopted a new robot strategy 2015. Japan’s number of senior citizens aged 65 and above hit the record high level of over 31.9 million (25.1% of total population) in 2013. The number of working age population for Japan is also on decline, currently dipping below the level of 80 million to 79.01 million. This has meant that social security costs for Japan hit a record ca. JPY109 trillion in the fiscal year 2012, accounting for 30% against the national income [3]. Part of the robot solution in Japan is to cater in aid to elder care, in reduction of medical costs and physical impairment due to advanced age.

Japan sees innovation in robotics as key to easing its social challenges. Set within the context of the era of IoT and virtual networks, it views advancement in robot technology as playing an integral role in the country becoming a global hub of robot innovation in both business (B to B) and consumer markets (B to C). A small enterprise, Mujin, founded in Japan in 2011 is currently working on intelligent controller technology that can be used across automation products [4].

Collaborative robots

There seemed a fair consensus that the future of robotics would revolve around not cost per unit of robot solution but rather ease of use for the customer. Prior to the concept of collaborative robots, automation in industries saw humans fenced off from robots as part of indsutry safety standards. The latest technological breakthroughs in robotics equips machines with in-built motion sensors that now allows for closer working proximity between humans and robots. Part of the ease of use in collaborative robots is also its capacity for intuitive lead through programming of the robot that requires little prior training on the part of the operator.

Per Vegard Nerseth, ABB Group Senior Vice President and Head of Robotics, participating in the Robot Summit 2015 panel discussion, on the topic of global trends that will fuel the development of the robotics industry in short to mid-term future.

A presentation slide from KUKA Roboter presented by its CEO, Stefan Lampa, on the eight megatrends of society that drive the robot industry.

YuMi – a flexible small parts assembly collaborative dual arm robot solution that is part of the relatively new but quick developing collaborative robot industry.

When it comes to robot customer solutions, ABB has identified three areas of focus that it saw will help define the future of the industry that includes collaboration / collaborative robots, simplification and integrated solutions.

References

[1] Benzell, S. G., Kotlikoff, L.J., LaGarda, G. & Sachs, J. D. 2015. Robots Are Us: Some Economics of Human Replacement, National Bureau of Economic Research working paper, February 2015. Internet resource at http://bit.ly/1ll6Bob. Retrieved 6 Dec. 2015.

[2] Business Insider 2015. The Robotics Market Report: the fast-multiplying opportunities in consumer, industrial, and office robots, Business Insider 13 May 2015. Internet resource at http://bit.ly/1OO8VgM. Retrieved 6 Dec. 2015.

[3] METI 2015. Ministry of Economy, Trade and Industry, Headquarters for Japan’s Economic Revitalization 2015. New Robot Strategy – Vision, Strategy, Action Plan. Interent resource at http://bit.ly/1N4XReB. Retrieved 6 Dec. 2015.

[4] Mujin, http://mujin.co.jp/en. Retrieved 30 Aug. 2017.